- GTI Bank adopts blockchain technology for enhanced security and efficiency in a bid to provide best-in-class services to its diversified clientele base.

- TM One to provide cloud hosting, cloud managed services, professional services and cybersecurity solutions to support GTI Bank's BlockChain System.

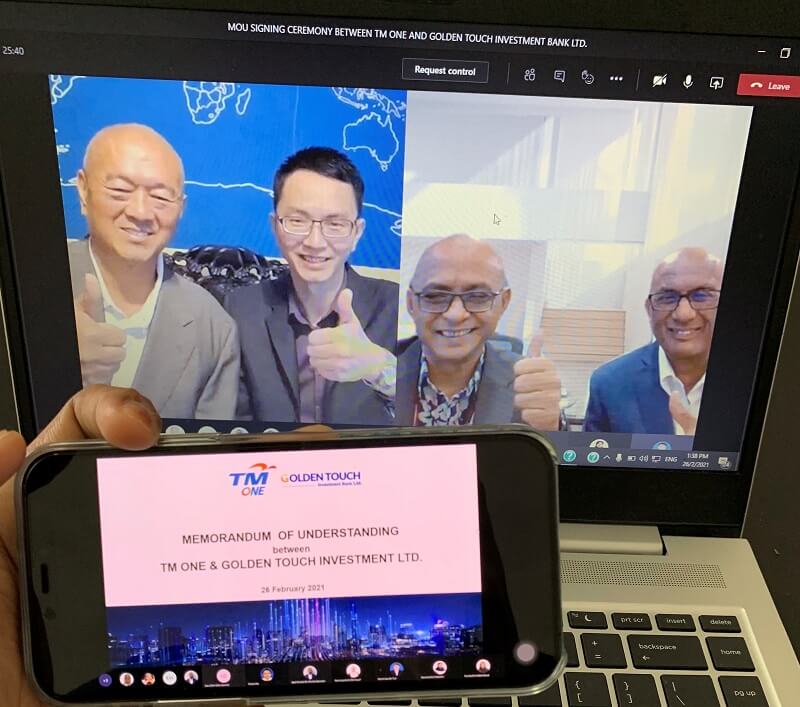

TM One, the enterprise and public sector business solutions arm of Telekom Malaysia Berhad (TM), today signed a Memorandum of Understanding (MoU) with Golden Touch Investment Bank Ltd (GTI Bank), for the appointment of TM One as the preferred digital partner to accelerate the bank's digital transformation. Under this partnership, TM One will be providing cloud hosting and cybersecurity services for GTI Bank to digitalise its service offerings for a better customer experience.

The MoU was signed by Tan Sri Lee Kim Yew, Founder of GTI Bank, while signing on behalf of TM One was Ahmad Taufek Omar, Executive Vice President and Chief Executive Officer of TM One.

At the signing ceremony, Ahmad Taufek said, "TM One is happy to announce this alliance with GTI Bank and ready to deploy our professional and support services, from migration to maintenance of the end-to-end cloud solution. We have the expertise and capabilities to accelerate the digital transformation journey of our enterprise customers across multiple industry verticals, including banking. Our TM One Cloud α (pronounced as Cloud Alpha) and secure, robust cybersecurity capabilities powered by TM's Global Security Operation Centre (GSOCs) are set to support GTI Bank's BlockChain System. This will enable the bank to deliver a simpler, faster and more convenient banking experience to its end customers."

"We understand that it is important for every blockchain users from different countries to be able to access the system without resistance. Our cloud solutions hosted on a high resiliency Data Centre, which is globally certified with Uptime Tier III standards, will minimise system downtime and ensure 24x7 business continuity for GTI Bank. The solutions will meet the bank's need for resilient cloud services and address customer's security, privacy and compliance requirements. This befits our role as the sole Malaysian Cloud Service Provider (CSP) under the MyDIGITAL – Malaysia Digital Economy Blueprint (MyDIGITAL)," added Ahmad Taufek.

Meanwhile, Tan Sri Lee said: "The potential of blockchain is enormous as we see more opportunities are emerging from this innovative technology. The world is now embracing digital technology at a pace faster than ever before, particularly in the banking and finance business. We are pleased to have TM as our digital partner as it would provide more confidence to our clients on the security and stability of the system."

"The strategic move of GTI Bank is also aligned with the MyDIGITAL Blueprint launched by the Prime Minister YAB Tan Sri Muhyiddin Yassin. We will help to create an effective digital ecosystem by leveraging on the full advantage of blockchain technology to propel the nation towards achieving a digital economy," added Tan Sri Lee.

This strategic collaboration combines the strength of both companies to enhance the digital initiatives, focusing on blockchain and platform technologies using cloud services, secured via cybersecurity solutions.

For further information on TM One, visit www.tmone.com.my and for more info on GTI Bank, visit www.bankgti.com

YOU MAY ALSO LIKE

Bank Islam appoints TM One as digital partner to accelerate its digital transformation

Bank Islam aims to become Malaysia's leading bank for social finance and digital Islamic bank of choice by 2021 TM One's digital solutions and professional services optimises business operations to realise Bank Islam's transformational strategy Comprehensive digital solutions such as data centre and Cloud α (Alpha) services, big data analytics and cyber-security solutions set to enhance Bank Islam's IT infrastructure and Centre for Digital Experience (CDX) digital banking products Telekom Malaysia Berhad (TM) via its enterprise and public sector business solutions arm, TM One, today signed a Memorandum of Understanding (MoU) with Bank Islam Malaysia Berhad (Bank Islam), for the appointment of TM One as the preferred digital partner in realising Bank Islam’s transformational strategy. The MoU was signed by Mohamed Iran Moriff Mohd Shariff, Chief Operating Officer of Bank Islam and Ahmad Taufek Omar, Executive Vice President and Chief Executive Officer of TM One. Commenting on the collaboration, Ahmad Taufek said, “We are honoured to be given the opportunity to extend our digital expertise to Bank Islam. We are fully aware that digital transformation, data security and protection are the top priority, especially for the banking sector. This provides the best digital experience to their customers, particularly in these times where digital transactions are increasing exponentially. With this agreement in place, we can provide Bank Islam with the latest and secured digital solutions and infrastructure to support its transformation journey. Solutions such as cloud, cybersecurity and big data analytics will drive Bank Islam’s process optimisation, enabling omni-channel and data monetisation agenda, leading to cost optimisation and productivity uplift.” “At TM One, we aim to take transformation forward for our enterprise and public sector customers, such as Bank Islam in realising their digital aspiration. This befits our role as part of TM Group, as the enabler of Digital Malaysia,” he added. Chief Executive Officer of Bank Islam, Mohd Muazzam Mohamed said, “As Bank Islam is embarking on a new endeavour by becoming Malaysia’s First Public Listed Islamic Bank, we are taking steps in pursuing the latest technological advancements in facilitating the affairs of the institution with our stakeholders. The partnership with Malaysia’s leading integrated telecommunication company such as TM will complement the Bank’s effort to constantly improve our functions and the services we provide to the customers, thus further fulfilling market’s need and expectations. This effort will then catalyse the growth of the Bank and the Islamic banking industry as a whole.” He adds, “We are very excited and look forward to a meaningful partnership with TM, via TM One as digitalisation will enable core infrastructure that will support Bank Islam’s key strategic pillars of Sustainable Prosperity, Value-based Culture, Community Empowerment, Customer Centricity, Real Economy as we move forward.” The collaboration between both parties is aimed at further exploring TM One’s role in becoming the primary digital solutions provider to Bank Islam for digital infrastructures such as data centre and Cloud α (Alpha) services, as well as big data analytics and cyber-security solutions. These solutions will intensify Bank Islam’s IT infrastructure and Centre for Digital Experience (CDX) digital banking products, by allowing new buying experience, away from the traditional banking approach. This partnership combines the strength of both companies that will pave the way to accelerate Bank Islam’s transformational strategy. For further information on TM One, visit www.tmone.com.my and for more info on Bank Islam visit www.bankislam.com

TM One is services partner and managed services provider of the year

Awarded honours at Cisco Partner Appreciation Dinner 2018 TM One, the enterprise and public sector business solutions arm of Telekom Malaysia Berhad (TM) recently was recognised by Cisco as its Services Partner and Managed Services Provider of the Year 2017 for Malaysia at the Cisco Partner Appreciation Dinner. Commenting on the latest recognition, Azizi A Hadi, Chief Executive Officer of TM One said, "It is our great honour to receive these outstanding awards from Cisco. These awards appropriately depict TM ONE's role as the only enabler for businesses to realise the full potential of their digital opportunities. It is also a strong testament to our commitment in providing trusted business solutions to our enterprise and public sector customers leveraging on Cisco's leadership in technology and innovation to drive digitalisation." "Over the years, we have established many collaborative efforts and TM One will continue to leverage on strategic investments with Cisco towards delivering seamless digital experience and integrated business solutions for business communication needs, true to TM's vision of "Making Life and Business Easier, for a Better Malaysia"," Azizi added. Meanwhile, Naveen Menon, President of Cisco ASEAN, stated, "Malaysia is one of the most digitised nations in Southeast Asia. We are excited to see Cisco technology growing and delivering the digital journey for governments, large enterprises and small / medium businesses across Malaysia. Our continued partnership with TM One is critical for us to further drive the digital transformation of all industries." Through TM One, TM enables its customers and partners' digital journey with seamless vertical and horizontal solutions toward their digital transformation. Positioned as the only enabler for businesses to realise their full potential of their digital opportunities, TM One offers solutions based on Cisco's leading technology in the areas of Networking, Collaboration, Security, Wireless and Mobility as part of its portfolio in helping Malaysian enterprises effectively grow their digital business at an effective cost. TM One is also Cisco's Certified Gold Partner and the first partner to sign as the Managed Services Provider for Cisco Meraki in Malaysia. For more information on TM One and its product offerings, log on to www.tmone.com.my/

TM ONE & SIRIM ACADEMY PARTNERSHIP BOOSTS CYBERSECURITY AND AI GOVERNANCE IN MALAYSIA

KUALA LUMPUR, 6 November 2025 – TM One, TM’s enterprise and government sector solutions arm, has signed a strategic Collaboration Agreement with SIRIM Academy, a subsidiary of SIRIM Berhad, to advance Malaysia’s capabilities in information security, artificial intelligence (AI) governance, and workforce certification. The partnership combines TM One’s expertise in cybersecurity and managed services with SIRIM Academy’s recognised strengths in training, consultancy, standards development and personnel certification. Together, the two organisations will support enterprises and government agencies in closing compliance gaps, adopting global best practices, and building resilience in the digital economy. The collaboration focuses on certification and workforce readiness, supporting organisations to comply with Information Security Management Systems (ISMS, ISO/IEC 27001) and the newly introduced AI Management System (ISO/IEC 42001:2023). TM One will provide operational security capabilities for monitoring and incident response, while SIRIM Academy will deliver professional certification programmes aligning with standards requirements and national frameworks. To ensure compliance, organisations can further leverage TM One’s Managed Security Services including its Security Operations Centre (SOC), Security Information and Event Management (SIEM), Managed Detection and Response (MDR), and Threat Intelligence, which offers continuous protection. The agreement also facilitates joint go-to-market opportunities, with TM One or SIRIM Academy leading client engagements as needed. The collaboration was formally made through an exchange of documents between Shanti Jusnita Johari, TM One’s Executive Vice President, and Dr. Mohd Bakri bin Jali, SIRIM Academy’s Chief Executive Officer (Covering), symbolising the start of a shared commitment to advance Malaysia’s digital trust and governance. Shanti Jusnita Johari said, “This partnership with SIRIM Academy reaffirms TM One’s position as a trusted digital enabler for enterprises and government. By embedding training, consultation and certification into our secure digital infrastructure, we ensure compliance is not only achieved on paper but sustained in practice. Together, we are building the human talent and governance frameworks needed for Malaysia to thrive as an advanced digital nation.” Echoing this, Dr. Mohd Bakri bin Jali also highlighted SIRIM Academy’s commitment, “As the training, consultancy and standards development arm of SIRIM Berhad, SIRIM Academy is committed to raising Malaysia’s industry standards and certification readiness. Partnering with TM One allows us to integrate our expertise in standards implementation with their operational capabilities, enabling organisations to adopt ISMS, AI governance and digital trust practices more effectively. This synergy enhances Malaysia’s competitiveness in the digital economy.” The partnership is the latest milestone in TM’s aspiration to become a Digital Powerhouse by 2030, ensuring enterprises and government agencies are equipped with secure, compliant and future-ready digital solutions.