Financial assistance for underserved local MSMEs from Funding Societies utilising Yellow Pages digital advertising solutions to help with business expansion and sustainability during these challenging times.

Funding Societies Malaysia, the largest peer-to-peer (P2P) financing platform in the country and Southeast Asia recently collaborated with TM Info-Media Sdn Bhd (TMIM), a subsidiary of Telekom Malaysia Berhad (TM) to offer business financing solutions for the underserved and unserved local micro, small and medium enterprises (MSMEs). The mission kicks off into high gear with the prime utilisation of Yellow Pages' digital platform, a product of TMIM and also the leading digital business directory in Malaysia.

The collaboration will provide MSMEs with greater access to digital financing solutions. The solutions will facilitate business expansions as well as ensure sustainability of the MSMEs. It provides vital financing options to existing MSMEs and serves as a launch pad to aspiring entrepreneurs. The synergistic collaboration takes momentous steps towards Funding Societies' mission to improve the livelihoods of MSMEs and TM's role as the enabler of Digital Malaysia.

It also opens the door for as many as 70,000 MSMEs under the Yellow Pages listings to a variety of tailor-made financing products. With the aim of bringing game-changing revolutions to their customers, Yellow Pages Malaysia is no stranger to making innovative transformations in order to stay current in the digital age.

Wong Kah Meng, Co-founder and Chief Executive Officer of Funding Societies Malaysia, commented on the partnership: "Digital financing is becoming more prevalent in Malaysia given its ability to promote financial inclusion, particularly benefiting the MSMEs that are either unserved or underserved by traditional financing avenues by providing easy access to financing solutions. As the largest P2P financing platform in the region, our partnership with TMIM will serve to accelerate our reach in providing the financing support that is much needed by our local MSME players. This is especially relevant given MSMEs are among the most impacted by the Covid-19 pandemic."

Meanwhile, Sean Koh Chin Soon, Chief Executive Officer, TMIM said: "Our Malaysia Yellow Pages platform which has evolved from print to digital, interactive website and mobile app, is the perfect avenue to bridge the MSMEs out there with the resources they require. We are excited to collaborate with Funding Societies Malaysia in empowering local businesses through financial solutions. This will enable them to further expand their potentials thus supporting the sustainability of the businesses, especially during this Covid-19 pandemic. This is also in line with the Government's efforts to boost the growth of Malaysian economy and to propel local businesses. This initiative is befitting of TM Group's unique role in nation building and as the enabler of Malaysia's Digital Nation aspirations."

P2P financing is a digital financing solution that has been gaining traction in recent years. Its modern approach and speedy process makes pain points of traditional financing a thing of the past. Such setbacks including collateral requirement, onerous documentation, slow turnaround time, and high minimum requirements, all posed as hurdles for smaller businesses to obtain quick financing assistance. Through this collaboration, eligible businesses on the Yellow Pages platform can apply for the financing from Funding Societies without even needing to visit a physical branch.

Eligible MSMEs stand to enjoy the following financing benefits from Funding Societies:

- Discount on processing fee

- Fast disbursement with quick approval within five (5) working days

- Flexible tenure of up to 18 months

- No collateral requirement

- Minimal documentation requirement

Besides the collaboration with Funding Societies, TM through its consumer and SME product brand, unifi has also been continuously assisting businesses to stay productive in this emerging digital economy. Via unifi Business Club (uBC) specifically for its SME customers, unifi enables access to complete business solutions which include digital marketing tools, productivity boosters and financial solutions. By allowing businesses to leverage on its strategic partnerships, unifi aims to expedite its customers' recovery and enhance sustainability.

Interested MSMEs can apply for financing from Funding Societies on Yellow Pages website starting 5 October 2020. For more information on the partnership between Funding Societies and TMIM, please visit https://biz.yp.my/solutions/yellowpagesfinancing/.

YOU MAY ALSO LIKE

unifi business campaigns for local small & medium enterprises with #BelanjaDiSME

In conjunction with World SME Day, TM’s retail convergence solutions arm calls for Malaysians to support growth of local SMEs & nation’s economic rebound Recognising the immense contribution of local Small and Medium Enterprises (SMEs) to the country's socioeconomic growth, unifi Business is marking SME Day 2022, which falls on 27 June, with a month-long campaign to help these local players get back on their feet post pandemic, while rallying all Malaysians to support their business growth. Using the hashtag #BelanjaDiSME, unifi Business alongside several renowned partners have lined up multiple activities such as a Social Media Challenge, the SMEs to SMEs talk shows, and a nationwide entrepreneurs roadshow to celebrate the significant role played by local SMEs in creating employment, promoting innovation and creativity, as well as contributing to the country's economic prosperity. #BelanjaDiSME (which means Spend with SME) was chosen to encourage Malaysians to buy products and services offered by local SMEs, boosting the profitability of these enterprises and contributing to their rebound, post pandemic. This campaign started off with a Social Media Challenge, where Malaysians are invited to upload a picture of any local SME of their choice on their personal social media space with a creative caption, tagged with the #BelanjaDiSME hashtag. Participants with the most creative picture and caption will be in the running to win attractive prizes such as a 3-day and 2-night stay at local holiday destinations, smart devices, shopping vouchers and many more. The challenge is now open right up until the end of June, and everyone can participate! Meanwhile, entrepreneurs seeking inspiration and ideas to grow their business can catch SMEs to SMEs talk show featuring stories of local SMEs on their digital transformation journey. This talk show can be watched live on unifi Business Facebook page as well as on Astro Awani. Tune in and listen to these successful entrepreneurs: Anna Teo - Hernan Corporation (largest and leading exporter of Malaysian durians) – 25 June on ASTRO AWANI at 10.30pm Joanne Goh - Jazzy Group (international film producer) – 27 June on Astro Awani at 9.00am Nadira Yusoff - Kiddocare (online babysitting platform) – 27 June on Sembang Bisnes unifi Business Facebook page at 3.00pm. A nationwide tour is being held throughout the month of June, to raise awareness among SMEs on the importance of digitalisation process for their business growth and development especially during this transition to endemic phase. This is in line with the Government's focus on empowering this target group and improving their living standards. To give local SMEs a shot in the arm, unifi Business will also promote the SME Digitalisation Grant (SDG) where the entrepreneurs can enjoy up to 50% savings on their subscriptions to digital solutions from unifi Business or get a RM5,000 matching grant, as part of the Pelan Jana Semula Ekonomi Negara (PENJANA) initiative announced by the Government in 2021. This is an opportunity for SMEs to increase their productivity while reducing their operating cost. The pandemic has undoubtedly impacted SMEs, forcing them to evolve into a more digital literate organisation in order to survive and thrive. unifi Business, as the preferred digital partner of SMEs, provides just the digital solutions they need to make this happen, which include: unifi eCommerce Hub: Designed to connect and maximise growth opportunities seamlessly, this solution offers a single and integrated platform, with an easy-to-use interface. Entrepreneurs can sync their offline and online sales channels, manage product inventories, orders, monitor sales and revenue, as well as manage social media enquiries. They can even build interactive websites with live chat and built-in online payment features. unifi Cloud Storage: To help businesses manage the often-tedious task of storing valuable information, this solution brings flexible, safe and scalable data storage. It also provides access for multiple users and secured encryption for better business productivity. Hosted locally at TM's Green Data Centre certified facilities, unifi Cloud Storage provides a secure home for important files and information so businesses can focus on growing and being profitable. unifi Business Club (uBC): All unifi Business customers will enjoy member benefits of the uBC, which include access to relevant and current content at its portal (https://ubc.unifi.com.my). Here, they can find insightful and inspiring content such as webinars, talk shows, live chats, events, business tips and articles to help them navigate the business world. uBC members will also enjoy access to financial assistance, productivity boosters, digital marketing platforms, tools and community engagement programmes that are tailored to a variety of business needs. For more info on unifi Business SME Day 2022 happenings, visit https://ubc.unifi.com.my/. Let's support and celebrate these local SMEs, together.

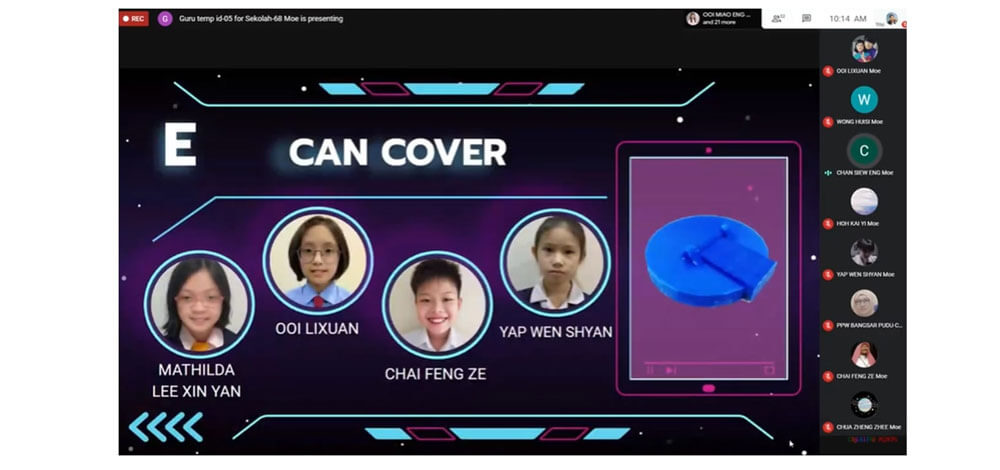

TM Future Skills Programme continues with a project based learning e-showcase event

Two (2) schools participated in E-Showcase PBL-TM Future Skills 2020, the highlight of a 3-month online learning programme for teachers and students of the schools Telekom Malaysia Berhad (TM) continues its efforts to equip the younger generation with Industrial Revolution 4.0 (IR4.0)-centric knowledge through initiatives under its TM Future Skills programme. Most recently, students from Sekolah Jenis Kebangsaan Cina (SJKC) Jalan Davidson, Kuala Lumpur and SJKC Tsun Jin, Kuala Lumpur demonstrated their talents in 3D programming and printing skills in a two (2)-days online event held in collaboration with Bangsar / Pudu District Education Office (PPDBP). The event, titled E-Showcase Project Based Learning (PBL)-TM Future Skills 2020, saw the participation of 60 teachers and students from both schools. The students showcased their 3D innovation projects and at the same time, shared and displayed their knowledge and skills in Science, Technology, Engineering and Mathematics (STEM) subjects. Izlyn Ramli, Vice President, Group Brand and Communication, TM, said: “We are delighted with the schools’ acceptance and active participation in the TM Future Skills Programme. Our Corporate Social Responsibility (CSR) programmes under the education pillar are always aimed at supporting the nation’s education system towards preparing not only the students, but also the teachers and society at large, with IR4.0 skills. We hope this programme will help to enhance the students' future skills and increase their interest in STEM subjects. This befits our role as a responsible nation builder where we will continue to serve and enable Digital Malaysia through innovative and inclusive digital solutions.” Teah Lay Theng, Headmistress of SJKC Jalan Davidson, said: “The PBL approach was chosen for the programme as it can bring out the most from the students in terms of innovation and creativity. The use of digital equipment is also able to improve the digital skills and competencies of our students in producing the innovations.” Meanwhile, Ng Mooi Hong, Headmistress of SJKC Tsun Jin, said: “In the current pandemic environment, teachers need to be creative in imparting knowledge and running the programmes that can develop the potential of our students. With this programme, we hope to inoculate the interest, highlight the potentials and empower the students with STEM subjects.” The E-Showcase PBL-TM Future Skills 2020 was the highlight of three (3) months long online learning programme for teachers and students of the two (2) schools. Throughout the programme, the teachers and students from both schools learned about digital technology in TM 3Ducation – the 3D printing module to be implemented in their PBL. Due to the ongoing pandemic Covid-19, TM’s strategic partner for TM Future Skills, Creative Minds, conducted the training sessions for all the teachers and students, including parents, through an online platform. Not being in class physically following the closure of schools nationwide has also not deterred these young innovators. They persevered in conducting research and continued to experiment and collaborated with each other virtually for the past 3 months. At the same time, School Improvement Specialist Coach (SISC+) from PPDBP closely supervised the activities and monitored the progress of the participants. Streamed live via YouTube, the E-Showcase garnered more than 6,000 viewers throughout the 2-day event and the channel has cumulated more than 7,800 views to date. The panel of judges for the E-Showcase consisted of SISC+ from PPDBP and led by Izad Ismail, Head of Corporate Responsibility, TM. TM Future Skills programme is an initiative that aims to empower students by equipping them and teachers with IR4.0-centric kits and knowledge, such as the TM 3Ducation – 3D printing module and the TM Nano Maker, a real-time data logging tool for STEM. This is to prepare them to be part of a digital-ready community and future-proof workforce which has always been one of the pillars under TM’s Digital Malaysia aspiration. As a key enabler of this, TM has always been an avid supporter of innovation and technology in Education. Through programmes like TM Future Skills, the Company endeavours to empower the leaders of tomorrow with relevant skills in innovation and technology towards serving a more digital society and lifestyle, digital businesses and industry verticals, as well as digital Government. For more information on the Company's other Corporate Responsibility initiatives, visit www.tm.com.my.

TM Records Stronger 2Q 2023 Financial Performance; Sustaining the Group’s Growth Momentum

KUALA LUMPUR, 25 August 2023 – Telekom Malaysia Berhad (“TM” or “the Group”) recorded a stronger financial performance in the second quarter of the year that ended 30 June 2023, compared to the same period in the previous year. Its operating revenue grew 0.3% to RM3.10 billion, propelled by Unifi’s expansion which saw a substantial increase to 3.11 million fixed broadband subscribers. The growth was also due to TM Global’s solid 10.0% revenue growth driven by higher demand for domestic and international data services. Profit After Tax and Non-Controlling Interest (PATAMI) rose 50.4% from RM378.0 million to RM568.7 million due to lower net finance cost and the recognition of tax credits from unutilised tax losses. TM’s Capital Expenditure (CAPEX) allocation for the first half of 2023 stood at RM942.8 million, which accounts for 15.6% of the overall revenue for the expansion of network infrastructure to enhance nationwide coverage. Meanwhile, Earnings Before Interest and Tax (EBIT) was lower by 10.3% at RM630.0 million from RM702.7 million, due to higher preventive maintenance costs to better serve our customers and higher depreciation from revision of asset useful life. TM declared a higher Interim Dividend of 9.5 sen per share. This is a testament of the Group’s positive financial performance and its ongoing commitment to shareholder value. Commenting on these results, Amar Huzaimi Md Deris, TM’s Group Chief Executive Officer said, “We are pleased with this quarter’s performance, which is marked by overall positive results across our Lines of Business (“LOBs”). These achievements further strengthen TM’s growth momentum in facing a more competitive market.” “In the coming months, TM expects to face a more challenging marketplace but remains confident in our overall positive financial performance. The Group remains steadfast to continue strengthening its core business to be commercially sustainable whilst also continuing to contribute to the nation’s growth. “TM is excited by the huge potential of fixed, mobile and lifestyle convergence in the digital market, as well as digital infrastructure and solutions for MSME, enterprise and government sectors, whilst pursuing to capture opportunities from International partners including hyperscalers. “We also remain committed to continuously invest in expanding our network to enable the nation’s progress towards a Digital Malaysia. TM will continue to collaborate closely with the Government to serve as the nation’s trusted partner to grow Malaysia’s overall connectivity and digital ecosystem, including 5G,” Amar concluded. LINES OF BUSINESS PERFORMANCE Unifi drives growth with enhanced services and market leadership Unifi’s revenue increased 0.5% to RM1.41 billion, driven by growth in fixed broadband subscribers reaching 3.11 million from consumer and Micro Small & Medium Enterprises (“MSME”) segments. Reinforcing its market leadership in fibre broadband services, Unifi unveiled its Ultra Gigabit Broadband Plans with 1Gbps and 2Gbps packages designed to empower digital households and expedite the growth of MSMEs. Unifi also strengthened its position by introducing innovative Uni5G postpaid and prepaid all-in-one 4G and 5G mobile plans, enhancing its fixed-mobile convergence value proposition. Unifi’s lifestyle services arm, Unifi TV, continued its pursuit of enriching user experiences by integrating popular streaming apps such as Netflix into its diverse portfolio. This move bolsters Unifi TV’s value proposition and adds to the variety of content available to users. The availability of a comprehensive convergence proposition encompassing gigabit fixed broadband, innovative 5G mobile packages and lifestyle services is the only offering of its kind in the industry. This is delivered over the best fibre network, superior 4G network coverage and expanding 5G nationwide footprint that offers elevated connectivity experiences at home and on-the-go. As a market leader, Unifi Business launched its Digital Marketing Solution (“DMS”) to encourage the MSME segment develop stronger brand presence and online visibility. As the latest addition to its line-up of connectivity and business solutions, DMS complements and augments Unifi Business’ existing offerings and will propel digital adoption among businesses. Earning further accolades, Unifi Business received the “Best Business Fixed Broadband Service Provider” award from PC.com during the period under review. TM One Drives Innovation with Smart Solutions and Private 5G Advancements TM One experience a decline in revenue by 11.4% to RM732.0 million in 2Q 2023 as a result of price reductions in connectivity services and lower one-off revenue from customer projects. To mitigate this, TM One is driving the rapid development of smart innovative solutions for verticals such as smart cities, healthcare, agriculture and industries. As a trusted digital partner for large enterprises and government, TM One is also leading Private 5G propositions and solutions across diverse industries spanning across oil & gas, transportation hubs and manufacturing to drive the country’s advancement. As the largest local cloud provider, TM Cloud Alpha remains the preferred local sovereign hyper-scaled cloud for data residency and locality in Malaysia. It has also reinforced its role in shaping Malaysia’s modern urban landscapes by being the strategic partner for smart city low-carbon initiatives with local councils. Along with its growing local and global partnerships, it has been appointed to implement and support various digital transformation programmes for its customers. In recognition of its industry excellence across a suite of end-to-end next generation business solutions, TM One received the accolade for "Best Enterprise Telco" from PC.com. TM Global on track to make Malaysia the preferred digital hub for ASEAN TM Global recorded a 10.0% solid revenue growth from RM739.9 million to RM813.6 million, contributed by higher demand for both domestic and international data services. TM Global remains steadfast in solidifying its stature as Malaysia’s preferred network infrastructure provider, catalysing digital industry and 4G/5G ecosystem while simultaneously positioning the country to become a digital hub for ASEAN. TM Global continues to deploy its 4G/5G fibre backhaul rollout and drive greater demand for High Speed Broadband Access (HSBA) ports, reinforcing its commitment to support the Government’s aspirations for digital inclusivity in the country. Beyond borders, TM Global has reinforced its position by enriching the platform play services via strategic collaborations with partners on A2P SMS Gateway in Philippines and Content Delivery Network (CDN) Last Mile Delivery in Thailand. Additionally, TM Global continued to cater to mega bandwidth requirements with dynamic and customised solutions for hyper-scalers as well as global service providers, cementing its significance on the international stage.