Both parties are collaborating on four (4) key areas of Digitally Empowered Businesses; Rural Digital Economy; Digitally Skilled Malaysians; and Digital Advocacy and Community Engagement.

Telekom Malaysia Berhad (TM) and Malaysia Digital Economy Corporation (MDEC) today announced a collaboration in the joint effort to further strengthen the digital readiness of Malaysia, towards realising its Digital Nation aspirations.

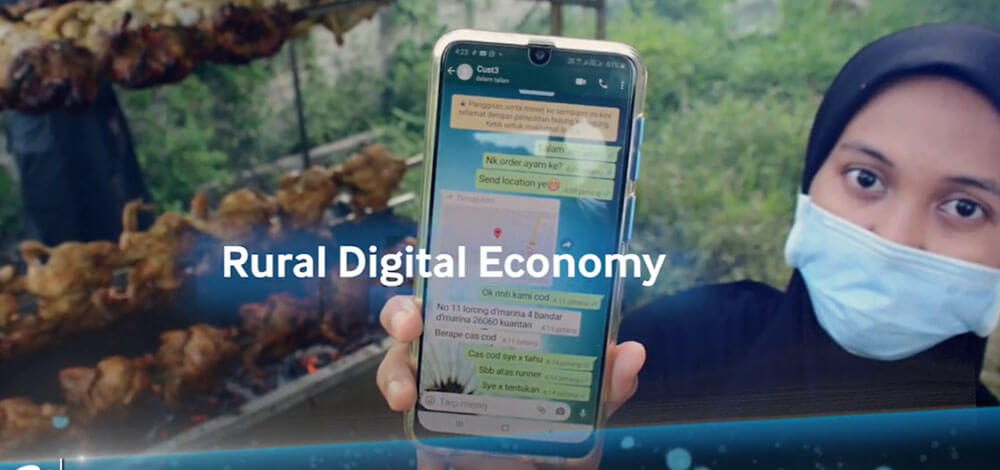

The collaboration encompasses four (4) key areas namely, to digitally empower Micro, Small and Medium Enterprises (MSMEs); to bolster rural digital economy; to empower Malaysians with digital skills; and to leverage on each other's strengths in running digital advocacy and community engagement programmes. More significantly, it brings the two national organisations, MDEC and TM, together moving in tandem towards delivering greater digital reach and economic impact for the shared prosperity of all Malaysians.

Under the MoU, TM and MDEC will work together in matching, introducing and connecting TM with MDEC's MSME ecosystem and established partners such as Perkhidmatan eDagang Setempat (PeDAS) programme, Pusat Internet Desa (PID) and Digital Xceleration (DX), as well as TM's MSME customers to offer products and solutions in TM's identified technology pillars towards further empowering the SME fraternity. This will pave the way towards producing business and technology savvy entrepreneurs, MSMEs who will then drive economic growth. Towards empowering the rural digital economy, both organisations will explore the initiatives to further expand connectivity infrastructure that in turn, can help enable mentoring and coaching to communities on how to increase the utilisation of emerging technology to improve business operations. Both parties will also look into organising training and workshops to enhance the digital skills and competencies of identified communities as well as TM employees, while at the same time building competent graduates to increase their employability. This includes promoting the awareness on 4th Industrial Revolution (IR4.0) related skills to teachers, students and youth to equip them for the digital era.

Commenting on the collaboration, Tan Sri Dato' Seri Mohd Bakke Salleh, Chairman of TM said: "We are excited and thrilled to join hands with MDEC in this milestone effort. Both national organisations will explore common ground and embark on the best initiatives towards establishing a solid foundation for the country's Digital Economy and to elevate Malaysia into a Digital Nation. This is also in line with TM's aspirations and unique role as the enabler of Digital Malaysia."

"What TM will bring to the table are our comprehensive infrastructure as well as our capabilities to reach out to not only our wide customer base but to more Malaysians nationwide, through our various touchpoints and engagement platforms. As we continue to engage with the communities to increase their awareness on digital solutions and how it can help fulfill their needs; we are also working to provide the future digital workforce with the right skills for a digital business ecosystem. As the national connectivity and digital infrastructure provider, we have always and will continue to support the Government's aspirations in increasing connectivity reach to all," he added.

"MDEC's collaboration with TM will complement the 'Malaysia 5.0' as the new narrative for introducing emerging technologies that will focus on accelerating the growth of Malaysia's digital economy in three primary areas: empowering Malaysians with digital skills, enabling digitally-powered businesses, and driving digital investments. Predominantly, the MDEC-TM joint effort is crucial to the new 'Malaysia 5.0' digital economy which will enable greater access and connectivity that will allow the nation to realise the full potential that the Fourth Industrial Revolution (4IR) holds for the economy. This goes to show that we are determined to surge the digital economy agenda for the many and to firmly establish Malaysia as the heart of digital ASEAN," said Datuk Wira Dr. Hj. Rais Hussin Mohamed Ariff, Chairman of MDEC.

In addition, the collaboration will look at potential community engagements via digital platforms for the knowledge sharing of products and solutions from both parties to address the communities' needs.

With this MoU in place, MDEC and TM will leverage on each other's strengths and complement areas where each entity requires further support towards a higher purpose of realising a Digital Malaysia and the benefits that it will give to more Malaysians; ensuring that no one will be left behind in this digital era and IR4.0.

YOU MAY ALSO LIKE

Unifi Mobile Honours Chinatown’s Heritage Through Immersive 5G Experiences

Kuala Lumpur, 9 December 2024 – Unifi Mobile and Unifi Business participated in the recent KL Chinatown Festival 2024 as the Official Telco Partner. KL’s Chinatown district came alive with fun filled activities to celebrate the local art scene, showcase its unique culture and support entrepreneurs. Located in the Petaling Street area, Chinatown offers a rich heritage with a unique mix of traditional Chinese and Malaysian architecture, and lively market stalls, attracting locals and tourists alike. As an official partner, Unifi played up this cultural and economic tapestry, engaging visitors and businesses during the festival. Jasmine Lee, Unifi’s Chief Commercial Officer, Consumer, said, "Petaling Street is a melting pot of diversity, culture and entrepreneurship. Our participation in the recent KL Chinatown Festival underscores our commitment to celebrating this historic landmark by supporting its art scene and local businesses through digitalisation.” “Our augmented reality (AR) mural painting added an innovative digital layer to Chinatown’s vibrant street art, blending creativity with 5G technology. We also empowered local entrepreneurs, offering complimentary workshops, as well as business consultations to help them in their digital transformation. These efforts align with our Digital Powerhouse aspirations to make technology more accessible, enabling a Digital Malaysia,” Jasmine added. Bringing street art to life Contributing to Chinatown’s rich and vibrant art scene, Unifi Mobile collaborated with a local artist to create a mural that symbolises the bold and vibrant spirit of young Malaysians. Powered by UNI5G, Unifi Mobile brought the mural to life through AR, offering visitors a unique way to engage with and experience street art via their smart devices. Championing the next generation of creative talents, Unifi Mobile also served as the partner and prize sponsor for the AR Fest KL 2024 that took place during the same weekend. Recognised by Opensignal* in 2023 as a global winner in 5G download speeds, Unifi Mobile offers seamless connectivity and a variety of value-driven plans that enable these innovative ideas. UNI5G Postpaid 39 subscribers now receive an additional 200GB of 5G data for only RM1 per month, complementing existing 30GB of 5G & 4G data and unlimited calls. For those seeking the latest devices, Unifi Mobile Postpaid includes 5G phones and unlimited 5G data starting from RM49 per month. Additionally, Unifi Broadband customers who switch to Unifi Mobile will receive six months’ complimentary UNI5G Postpaid 69, which includes unlimited 5G + 4G data, unlimited calls, and 60GB hotspot. Empowering local businesses Unifi Business, the digital solutions partner to Malaysia’s micro, small and medium enterprises, played a part at the festival, offering complimentary workshops on Digital Marketing Solutions and business consultations to local businesses in Chinatown. This provided local entrepreneurs deeper insights into how to expand their brand presence among today’s digital customers and grow their businesses through Unifi Business’ solutions that are tailored to their needs. For more information on Unifi, visit @unifi on Instagram, @unifi.mobile on TikTok, or @weareunifi on Facebook. *Opensignal Awards – 5G Global Mobile Network Experience Report, Group 1, October 2023, based on independent analysis of mobile measurements recorded during the period 1 January – 29 June 2023 © 2024 Opensignal Limited.

Communications and Multimedia Minister confident with nation’s digital infrastructure after visit to TM Network Operations Centre

Communications and Multimedia Minister, YB Tan Sri TPr Annuar Haji Musa expressed his confidence with the nation’s digital infrastructure to deliver Malaysia’s communications and digital aspirations for now and into the future. He expressed this after a working visit to the TM Network Operations Centre in Cyberjaya today. “I’m very happy with the visit today and from what I see, I’m confident that we have the people, capabilities and infrastructure to ensure 100% connection all over the country. We will leave no Malaysian behind,” YB Tan Sri TPr Annuar Haji Musa said after the visit. TM’s state of the art network operations centre serves as the brains of the nation’s digital and communications infrastructure managing over 600,000 km of communications cables and over 26,700TB data daily. The centre also monitors the health and operations of the 30 submarine cable systems that carries 1,990TB of internet data into and out of the country. Commenting on the visit, TM’s Chairman, Dato’ Mohammed Azlan Hashim said, “We are honoured to have YB Tan Sri TPr Annuar and his senior officers from the Ministry and MCMC with us. This visit gives us the opportunity to showcase the various customer segments we serve and the strength of digital technology available and ready to serve our customers.” “Befitting our unique and important role as the nation’s connectivity and digital infrastructure provider and the enabler of Digital Malaysia, we are ready to serve Keluarga Malaysia with our comprehensive communications and digital solutions. As a Government-Linked Company (GLC), TM remain commited to contribute towards the country's development through telecommunications and digital in support of the country's digital aspirations including JENDELA and MyDIGITAL towards accelerating the country towards a full-fledged Digital Malaysia by 2023,” he added. The visit today is expected to nurture even closer ties between both parties.

Orbix International School takes safety seriously by adopting TM R&D’s EWAR

TM R&D assists Orbix International School in adhering to the Standard Operating Procedures (SOPs) with deployment of EWAR towards curbing the spread of COVID-19 virus. Telekom Malaysia Berhad (TM), through its innovation arm, TM Research & Development (TM R&D), further promotes the adoption of digital solutions in the education sector by deploying its Early Warning, Alert & Response or "EWAR" at Orbix International School (Orbix), a private school in Muar, Johor. EWAR is an Artificial Intelligence (A.I) driven contactless temperature screening solution internally-developed by TM R&D. In an effort to digitalise the Standard Operating Procedures (SOPs) outlined for schools, Orbix has installed EWAR Compact, one (1) of EWAR's product categories, within their premise to better facilitate the temperature screenings of their students, teachers and visitors towards curbing the spread of COVID-19 virus. Commenting on the initiative, Dr. Sharlene Thiagarajah, Chief Executive Officer, TM R&D said, "We are honoured to be working with an educational institution such as Orbix to deploy our cost-effective and innovative solution in response to the required safety protocols. This illustrates the flexibility and readiness of education vertical in adapting to the new normal. At TM R&D, we are ever ready to assist businesses and organisations to get back on their feet safely." "We truly believe that deploying the EWAR Compact at schools or any educational institutions can provide students and teachers with a near-normal return to school experience as possible. We hope that this effort can encourage other schools and educational institutions to install EWAR Compact and simplify the adoption of the new SOPs in our battle against COVID-19." EWAR Compact is an AI-driven, one-on-one contactless thermal screening solution with a high accuracy of +/- 0.3℃, fast (~1sec) detection and voice prompt. In addition, AI-based facial recognition capabilities can also be applied with the solution. With EWAR Compact, students and teachers can go to schools with peace of mind, knowing that their schools are using the most effective technology available to safeguard their health. "Besides that, we are delighted to see more schools adopting digital solutions as this will expose teachers and students on how technology can help improve lives through safety. The exposure to EWAR Compact will also help students to experience digitalisation in action first-hand, and witness the benefits of digital adoption even before they enter the workforce. We hope this will help groom an industry-forward talent pool which will subsequently drive the nation's digital aspiration, befitting TM Group's role of the enabler of Digital Malaysia," she added. "Deploying EWAR Compact was a vital step for us as we were looking for the most effective technology available in safeguarding the health of our students and teachers. So far, we have received positive feedback on how EWAR Compact has enhanced the efficiency of temperature taking while simultaneously improving social distancing," said Govindan Nair, Chief Marketing Officer of Orbix Education. "The students especially have shared that they like how interactive the solution is. As we are firmly committed to ensuring the health and safety of our students, it is also important for us to expose our students to how innovation results in real-world solutions," he added. Back in July, TM R&D has successfully installed EWAR Compact at 12 selected schools under the purview of Bangsar / Pudu District Education Office (PPDBP) namely Victoria Institution, Sekolah Menengah Kebangsaan (SMK) Dato' Lokman, SMK Seri Saujana, SMK Desa Petaling, SMK Cochrane, SMK Taman Maluri, SMK Alam Damai, SMK Bukit Jalil, SMK Dato' Onn, SMK (P) Bandaraya, SMK Convent Jalan Peel and SMK Seri Permaisuri. During the early stages of the Movement Control Order (MCO), TM R&D has introduced two (2) main product categories under EWAR, namely EWAR Crowd and EWAR Compact as part of its contribution in the fight against COVID-19. The solution comes with four (4) main capabilities that close the critical loop from detection to containment. It is non-intrusive and has use-cases for both crowd and one-on-one scanning, respectively. EWAR Crowd comes with a dual-camera (thermal and optical) and is designed to conduct a rapid body temperature screening of approximately 10-15 individuals per second simultaneously at high traffic areas. It can easily be deployed in locations with mass traffic flow such as offices, shopping complexes, transportation hubs, universities, schools, tourist attractions, airports, immigration centres, and hospitals. EWAR Compact on the other hand is more suitable for a one-on-one contactless thermal screening. This can eliminate the need of the hand-held temperature taking, which can subsequently improve social distancing and minimise long queues. Both EWAR models have been installed at more than 150 sites across several industry verticals and have gone regional to help keep businesses safe beyond Malaysian shores. The solutions have been installed at the quarantine and treatment centre for COVID-19 cases at Malaysia Agro Exposition Park (MAEPS) in Serdang, large and mid-size office lobbies, hotels, Kuala Lumpur City Hall (DBKL) payment counters, various sales galleries and Gamuda Land construction sites, just to name a few. TM R&D has been growing from strength to strength since 2016, winning seven (7) globally recognised awards over the last two (2) years. Our innovations cut across multiple verticals such as the Smart Retail Analytics and Smart Safety Helmet, all developed internally by local talents in TM R&D. As the organisation continues to expand beyond connectivity and into new value-added digital and smarter platforms, its role in TM has become more prominent and exciting. For more information about TM R&D and its products and services, please log on to www.tmrnd.com.my. Follow us on LinkedIn (TM Research & Development) for more news and updates.