Safety protocols activated – outlet closed for sanitisation till 27 December 2020

Telekom Malaysia Berhad (TM) wishes to confirm one (1) new positive case of COVID-19 amongst its employees at TMpoint Kajang on 13 December 2020. The employee is currently receiving treatment at a Government hospital.

Following the confirmed case, TM has taken immediate action to close its TMpoint Kajang until 27 December 2020 for disinfection and sanitisation in accordance to the guidelines set by the Ministry of Health (MoH). Meanwhile, other TMpoint outlets remain in operations in adherence to the Standard Operating Procedures (SOPs) as well as TM’s added safety guidelines to ensure our customers continue to be served. TM management and staff are together praying for the speedy recovery of all those affected by the pandemic.

Meanwhile, detailed contact tracing is being carried out by the MoH, assisted by TM’s COVID-19 Crisis Response Team (CRT), to identify and inform those whom had close contact with the positive case. Identified close contacts are being contacted by MoH for further advice and action.

TM would like to remind everyone at all times to stay safe – practice social distancing, maintain personal hygiene and adhere to the SOPs as advised by the Government. TM would like to reiterate that it has taken and will continue to take all necessary measures to ensure the health and safety of its customers, employees and community.

YOU MAY ALSO LIKE

TM’S PAKEJ PERPADUAN JALUR LEBAR TETAP (HOME INTERNET) AIMS TO DRIVE DIGITAL INCLUSIVITY FOR MALAYSIANS

Telekom Malaysia Berhad (TM) has today announced the launch of its Pakej Perpaduan Jalur Lebar Tetap (Home Internet) for underserved communities in Malaysia, in response to the challenges faced by these key communities in the digital age. The offering is aligned with the Ministry of Communications and Digital’s efforts to address concerns of underserved Malaysians from the B40, the elderly, OKU, and army-police veterans in accessing reliable and affordable internet services. Following Minister of Communications and Digital, YB Fahmi Fadzil’s announcement today during the launching ceremony in Bakar Arang, Sungai Petani, Kedah, Pakej Perpaduan Jalur Lebar Tetap is now available for subscription nationwide. This collaboration between TM and the Government demonstrates the shared commitment to deliver digital inclusivity throughout Malaysia. Underserved communities often experience adversity in accessing the benefits of the digital world and uninterrupted connectivity. Students from low-income households, for example, face challenges in accessing online learning platforms, while job seekers may struggle to find employment opportunities or even in starting up small e-Commerce businesses to support their livelihoods. Additionally, a lack of access to digital services and information can limit options for essential services, such as healthcare and Government services. Via this offering, TM seeks to bridge the digital divide through hyperconnectivity and empower these communities with the necessary tools and resources to succeed in the digital age. “As a conscientious corporate entity, TM has a social responsibility to create a meaningful impact on the community. Unifi’s fixed broadband services will be available at a more affordable rate, ensuring that more Malaysians have access to reliable internet connectivity. This will not only enhance their online experience but also enable them to participate in the digital economy, which is crucial for the country's economic growth,” said Tengku Muneer Tengku Muzani, TM’s Chief Corporate and Regulatory Officer. “Access to good connectivity will enable greater access to education and job opportunities, as well as information and services that are increasingly being delivered online. It will also allow individuals to stay connected with their loved ones, regardless of physical distance. Furthermore, it will provide a platform for underserved communities to voice their concerns and engage in broader societal discourse.” “TM stands as the foremost provider of fixed broadband services in Malaysia, delivering superior connectivity and services, bridging the digital divide. As a Public Listed Company (PLC) and Government-Linked Company (GLC), TM is uniquely positioned to balance the interests of its stakeholders, ensuring commercial sustainability while enabling digital inclusivity and driving national development initiatives. With a commitment to excellence and innovation, TM remains dedicated to delivering the best broadband experience and driving a Digital Malaysia. We remain committed to providing innovative solutions and services that cater to the evolving needs of all Malaysians. We believe that everyone should have equal access to the benefits of the digital world, and are proud to be at the forefront of this effort,” added Muneer. Unifi’s Pakej Perpaduan Jalur Lebar Tetap offers an unlimited fixed broadband package at RM69 with savings of RM480 across 24-months, for all new and existing Unifi customers from those key target segments. Registration is open until 31 December 2023 for all eligible subscribers, but will be limited to only one (1) package per person. Earlier in March, TM also announced Pakej Perpaduan Prabayar Mudah Alih (Prepaid Mobile) and together, these services will enable ubiquitous connectivity and reinforces TM’s fixed-mobile convergence leadership, offering integrated fixed broadband, mobile services, and digital content to more Malaysians. Both of these offerings will be provided through Unifi Home and Unifi Mobile respectively. “The benefits of this initiative are manifold, and we hope to better empower underserved communities and give them access to the resources and opportunities that the internet has to offer. This initiative is a testament of our commitment to social responsibility and in creating a more connected world. It also speaks to our vision of becoming a human-centred TechCo, leveraging technologies to provide equal opportunities for every Malaysian. Through our role in digital nation building, we are committed to serving the nation’s interest more directly and to bring greater impact to our diverse communities,” concluded Muneer. For more information on Unifi’s Pakej Perpaduan Jalur Lebar Tetap, visit the Unifi portal at unifi.com.my or any TMpoint outlets nationwide. Alternatively, you may also reach us through our digital channels: · Live Chat at maya.unifi.com.my or via MyUnifi app · Facebook at facebook.com/weareunifi · Twitter at @helpmeunifi

TM's addresses data breach of Unifi mobile customers contact information

Telekom Malaysia (“TM” or “the Group”) has been made aware of a data breach (specific to contact information only) on 28 December involving a limited amount of Unifi Mobile customers’ information. After investigations, TM has found 250,248 Unifi Mobile customers to be affected in this data breach, constituting both individual customers as well as SMEs. The type of data that was breached involved customer names, phone numbers and emails. No other information was breached. TM confirms that the breach has been contained and have taken steps to minimise the potential impact to these 250,248 customers. The specific customers affected have been notified. Customers who have not received any notification are not impacted. TM has also reported this matter to the relevant authorities (National Cyber Coordination & Command Centre (NC4); Department of Privacy & Data Protection (JPDP); and the Malaysian Communications & Multimedia Commission (MCMC)). While additional security measures have been put in place to isolate the risk and protect our customers, we wish to inform that our customers did not experience any service disruptions in this incident. TM is closely monitoring the situation and is conducting additional assessments. We advise customers to take extra precautions when receiving communications from unknown parties, as well as to secure their online information at all times. The privacy and security of TM’s customers remain our highest priority and we take such matters seriously. We will continue to strengthen and ensure our data security framework, policies, systems and processes are continuously benchmarked against Bank Negara Malaysia's Risk Management in Technology (RMiT) standard and ISO27001, as well as other global standards to prevent such occurrences.

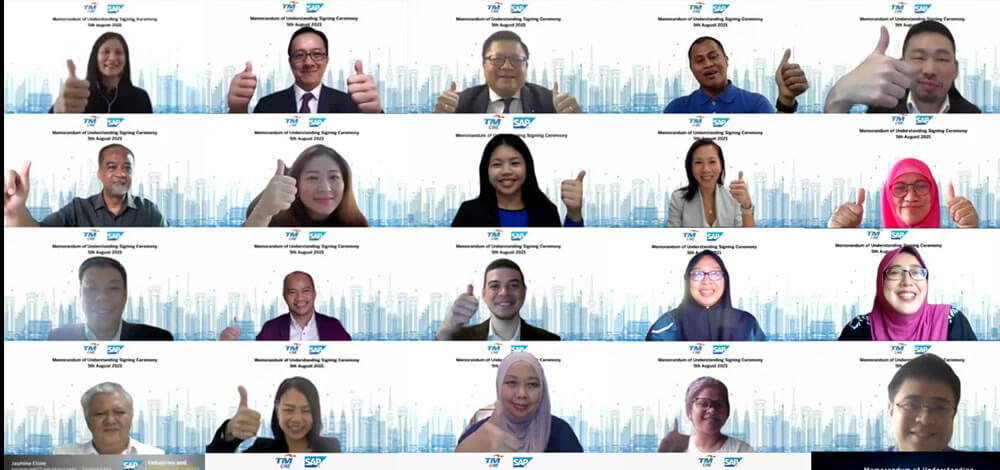

TM One teams up with sap to become first local hyperscaler for partner managed cloud

This collaboration is aimed at empowering enterprise digitalisation to drive and support MyDIGITAL aspirations towards a technologically advanced economy via SAP and TM One’s Cloud infrastructure TM One, the enterprise and public sector business solutions arm of Telekom Malaysia Berhad (TM) and SAP Malaysia Sdn Bhd (SAP), recently signed a Memorandum of Understanding (MoU) for a strategic collaboration to accelerate the digital transformation of Malaysian enterprises and to improve their operating efficiency through digital solutions. The event also announced the appointment of TM One as the first local hyperscaler to become the Partner Managed Cloud (PMC) provider for SAP business suite solutions in Malaysia. With this appointment, TM One's α Edge (pronounced as Alpha Edge) will provide cloud infrastructure to empower SAP's Enterprise Resource Planning (ERP) solutions in meeting the business needs of TM One's enterprise customers. Commenting on the appointment, Shazurawati Abd Karim, Executive Vice President of TM One said, "The appointment by SAP Malaysia is another milestone for TM One as we continuously expand and strengthen our Cloud α offerings. This time, we are making available to our customers the largest sovereign-Cloud to empower SAP Business One solutions targeted at SME and medium-sized enterprises. With this solution, our customers will be able to enjoy secure, world-class Cloud-based enterprise business solutions, hosted on TM One's intelligent Cloud – α Edge cloud infrastructure. It provides unmatched Cloud connectivity and cybersecurity as well as full data residency in Malaysia." "SAP is a renowned global technology powerhouse that has accelerated the digitalisation of millions of businesses through its ERP solutions. We view this appointment as timely in TM One's continuous journey towards taking transformation forward for Malaysian enterprises. As we innovate and continue to empower our customers in the current digital economy, SAP is the right organisation to drive the digital transformation of businesses, thus elevating the country into Digital Malaysia. This befits TM Group's unique role as the enabler of Digital Malaysia's aspirations, committed to serving a more digital society, digital business, digital industry and digital Government," added Shazurawati. As SAP's PMC provider, TM One is able to offer its customers a full subscription-based model of SAP Business One hosted on TM One's α Edge, bundled with managed services. This arrangement enables organisations to migrate their enterprise systems to the Cloud with confidence, visibility, and predictability. Through this approach, TM One customers will also be able to enjoy ready-to-use fully managed solutions, rapid time-to-value, lower total cost of ownership (TCO) and scalability and flexibility in deployment. In addition, TM One is in discussions with SAP to finalise its scope of offerings by expanding the PMC programme to SAP S/4HANA Intelligent Enterprise solutions to target large enterprise customers. As part of this tie-up, TM One and SAP will also explore a co-creation and innovation partnership that entails transformation initiatives for 5G use cases, Customer Experience, Procurement & Digital Supply Chain and Human Experience Management. Meanwhile, Hong Kok Cheong, Managing Director, SAP Malaysia said: "True digital transformation is the fundamental rethinking of the customer experience, business models, and operations to find new ways in delivering value, generating revenue and improving efficiency. This can be done by leveraging intelligent technologies such as ERP solutions, Artificial Intelligence (AI) and the Cloud. With SAP solutions hosted on TM ONE's α Edge, businesses can harness the power of their data and build a truly intelligent enterprise, while accelerating trusted outcome-driven innovation, real-time decision making, and thrive in the digital economy." SAP is today the world's leading enterprise applications provider. Across the globe, SAP customers include 92% of the Forbes Global 2000 companies, 98% of the 100 most valued brands, 97% of the greenest companies (according to Newsweek), while approximately 80% of SAP's customers are SMEs. For more information about TM ONE Cloud α solutions, visit www.tmone.com.my/solutions/cloud-services and for more information on SAP, visit www.sap.com/sea/index.html.