KUALA LUMPUR, 6 MARCH 2024 – Unifi Mobile today announced its newest UNI5G WOW Prepaid offering with unlimited 5G + 4G data, uncapped 5G speed and rewards that meet the growing needs of Malaysian prepaid mobile users. These new offerings provide customers with great value, choice and flexibility to enjoy today’s on-the-go lifestyle needs.

Whether for study, work or leisure, having uninterrupted worry-free internet experience at an affordable price is a must. Prepaid users, especially Malaysian youth, are known for their diverse interests including social interactions, online gaming, streaming and the use of various apps wherever they go. This reinforces the need for a mobile plan with generous data allowances, high speed connectivity and other additional perks.

The new UNI5G WOW Prepaid starter pack comes with 10GB data (5G + 4G) and a whopping 30-day validity for just RM10. Customers can purchase this UNI5G WOW Prepaid starter pack online and will receive a complimentary Unlimited 5G Larut Malam Pass. In conjunction with the launch, the UNI5G WOW Prepaid starter pack will be offered for free as an exclusive online promo via Unifi Mobile app or Unifi eStore for customers who want to maintain their existing number.

Jasmine Lee, Unifi’s Chief Commercial Officer, Consumer, said, “The evolving landscape of prepaid mobile services inspired us to re-evaluate what our users really need. We are thrilled to introduce our brand new UNI5G WOW Prepaid that has been tailored to modern prepaid users, and is among the few market offerings with uncapped 5G speed all day long.

“All UNI5G WOW data passes come with 5G connectivity at no additional cost. Now, everyone can enjoy the benefits of 5G connectivity at blazing fast speeds. We have also integrated our prepaid services into our new Unifi Mobile app, which also hosts our postpaid services, delivering a streamlined experience for all our users.”

Today, Unifi is Malaysia's leading convergence champion, evident by the recent recognition from Opensignal's 5G Global Mobile Network Experience Awards for 2023*. The UNI5G WOW Prepaid plan bolsters Unifi’s fixed, mobile, lifestyle and business offerings and aligns with its commitment to enriching lives and communities through technology.

UNI5G WOW Prepaid Plan Offerings UNI5G WOW offers data passes that are customised to suit diverse customer needs. Unifi Mobile’s latest suite of prepaid products include: -

1. UNI5G WOW 35 – Priced at RM35 per month, this best seller pass offers unlimited 5G + 4G data, uncapped 5G speed all day long, and unlimited calls. Subscribers will also enjoy a 10GB hotspot and for a limited time period, customers will get extra 50GB of 5G hotspot data for free, perfect for sharing with friends and family.

2. UNI5G WOW 25 – This pass is priced at RM25 per month, ideal for users with moderate data needs and usage. It comes with 30GB worth of 5G + 4G data, uncapped 5G + 4G speeds and hotspot functionality (shared quota derived from the 30GB data allocation).

3. UNI5G WOW 10 – For just RM10, subscribers will receive 10GB worth of data with uncapped 5G speed all day long. This weekly pass is ideal for users who seek connectivity without straining their budget.

On top of these exciting new passes, UNI5G WOW Prepaid is also offering on-demand add-ons, starting from RM1. Among these new add-ons are a weekend data pass, a speed booster pass, validity extension passes and call passes. For avid content creators and enthusiasts of platforms like YouTube and TikTok, a dedicated pass for these specific social media platforms is also available.

Existing customers on older rate plans are encouraged to switch to the new UNI5G WOW Prepaid via the Unifi Mobile app or by visiting the nearest TMpoint / Unifi Store. The plan change is offered free of charge and upon completion, existing customers are entitled to receive 10GB of data (5G + 4G) with a validity of 30 days.

To subscribe to the all-new UNI5G WOW Prepaid, simply download the Unifi Mobile app or visit the nearest TMpoint/Unifi Store and authorised Unifi Mobile dealers.

To find out more about the UNI5G WOW Prepaid, visit unifi.com.my/prepaid

YOU MAY ALSO LIKE

New exclusive through unifi TV: Lionsgate play treats Malaysian viewers with premium content

Starting July until 12th October 2022, all new and existing unifi TV Packs subscribers (Ultimate Pack, Varnam Plus Pack, Aneka Plus Pack and Ruby Plus Pack) can enjoy 90-day access to Lionsgate Play for free when they activate it through https://activate.unifi.com.my/lgp/. Introduced to Malaysian audiences in October last year, the international streaming platform offers unique blockbuster movies, premium originals, old favourites and binge-worthy TV shows that resonate with urban audiences between the ages of 25 to 45. From action, drama, and romance to thrillers and comedy, Lionsgate Play Malaysia in partnership with unifi TV offers several exclusive premium titles for the whole family. Anand Vijayan, TM’s Chief Commercial Officer and EVP, unifi said, “The inclusion of Lionsgate Play with unifi TV Packs provides comprehensive streaming entertainment for multi-generational audiences both at home and on the go. “With Malaysian households often made up of extended, multi-lingual families, this offering caters to the preferences of all members of a family – bringing something for everyone all within a single subscription.” “We are pleased to be the exclusive partner of Lionsgate Play in Malaysia and to bring more international content to our shores. Available via mobile app, web browser and unifi Plus Box, our subscribers can stream world-class content anytime, anywhere and on any smart device,” he added. Amit Dhanuka, EVP, Lionsgate said, “We are glad to further strengthen our relationship with unifi by amping up exclusive global entertainment on the Lionsgate Play platform in Malaysia. The upcoming titles stands testament to the bespoke content that we aim to provide Malaysian viewers. The current releases and our vast premium library encapsulate an array of genres including drama, action, thriller and more, that cater to local audience preferences.” Lionsgate Play releases new titles every Friday and provides highly curated playlists for audiences to choose from so they can ‘Play More and Browse Less’. This addresses one of the biggest challenges for busy working adults who often wonder what to watch next and may often spend more time browsing for content than actually enjoying it. unifi subscribers will now be able to enjoy these brand new exclusive titles, available only on Lionsgate Play: TV Series: Gaslit – A political thriller based on the Watergate Scandal involving US President Richard Nixon from 1972 to 1974, Gaslit tells the story from five months before the infamous break-in at the DNC headquarters. Nominated for four Emmy Awards in 2022, the series stars Hollywood’s leading names – Julia Roberts, Sean Penn, and Dan Stevens. The “Power” franchise – James "Ghost" St. Patrick is a wealthy New York nightclub owner who has it all, catering to the city's elite while also living a double life as a drug kingpin. Created by Courtney A. Kemp and executive producer Curtis “50 Cent” Jackson, this popular crime series has run for six seasons with three additional chapters – perfect for a crime-thriller binge fix. Becoming Elizabeth – the untold story of England’s most iconic Queen, long before she ascended the throne. Henry VIII’s death throws a young orphaned Elizabeth Tudor into the unpredictable and dangerous English court. As her 9-year-old brother is crowned king, Elizabeth can either become a pawn or player. Gomorrah – based on Robert Saviano’s best-selling novel of the same name, and directed by Marco D’Amore and Italian film director Claudio Cupellini, this acclaimed show explores organised crimes in Italy, putting audiences at the edge of their seat. The show stars Marco D'Amore, Salvatore Esposito, Arturo Muselli, Ivana Lotito, and Andrea Di Maria. Movies: Corrective Measures – a sci-fi movie set in the world's most dangerous maximum-security penitentiary, tensions among inmates and staff heighten, leading to anarchy. The gripping story stars Bruce Willis and Michael Rooker, and is written, produced and directed by Sean O'Reilly based on the graphic novel by Grant Chastain. Vendetta – when his daughter is brutally murdered, William Duncan takes the law into his own hands. After killing the street thug directly responsible for her death, he finds himself in a war with the thug's brother and his gang, who are equally hell-bent on getting revenge for their fallen member. Another Bruce Willis film, the movie also stars Thomas Jane and Theo Rossi. Jungle Cry – a riveting sports drama based on the real-life story of Indian rugby coach Rudraksh Jena of Bhubaneswar's Kalinga Institute of Social Sciences (KISS), who guided a team of 12 rural Odisha boys to a historic victory in the Junior Rugby World Cup in England in 2007. Starring Abhay Deol and Emily Shah, the film is helmed by Sagar Ballary. “With curated content from around the world, Lionsgate Play offers great value entertainment to Malaysian audiences, providing a variety of choices that the whole family can enjoy. Coupled with other unifi TV Packs, we are bringing streaming services to the next level – creating a new entertainment experience for customers of all ages,” concluded Anand.

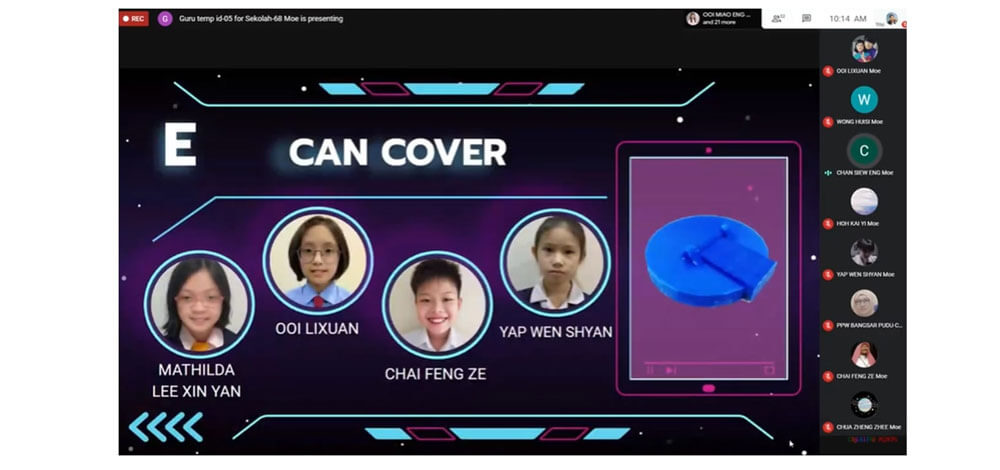

TM Future Skills Programme continues with a project based learning e-showcase event

Two (2) schools participated in E-Showcase PBL-TM Future Skills 2020, the highlight of a 3-month online learning programme for teachers and students of the schools Telekom Malaysia Berhad (TM) continues its efforts to equip the younger generation with Industrial Revolution 4.0 (IR4.0)-centric knowledge through initiatives under its TM Future Skills programme. Most recently, students from Sekolah Jenis Kebangsaan Cina (SJKC) Jalan Davidson, Kuala Lumpur and SJKC Tsun Jin, Kuala Lumpur demonstrated their talents in 3D programming and printing skills in a two (2)-days online event held in collaboration with Bangsar / Pudu District Education Office (PPDBP). The event, titled E-Showcase Project Based Learning (PBL)-TM Future Skills 2020, saw the participation of 60 teachers and students from both schools. The students showcased their 3D innovation projects and at the same time, shared and displayed their knowledge and skills in Science, Technology, Engineering and Mathematics (STEM) subjects. Izlyn Ramli, Vice President, Group Brand and Communication, TM, said: “We are delighted with the schools’ acceptance and active participation in the TM Future Skills Programme. Our Corporate Social Responsibility (CSR) programmes under the education pillar are always aimed at supporting the nation’s education system towards preparing not only the students, but also the teachers and society at large, with IR4.0 skills. We hope this programme will help to enhance the students' future skills and increase their interest in STEM subjects. This befits our role as a responsible nation builder where we will continue to serve and enable Digital Malaysia through innovative and inclusive digital solutions.” Teah Lay Theng, Headmistress of SJKC Jalan Davidson, said: “The PBL approach was chosen for the programme as it can bring out the most from the students in terms of innovation and creativity. The use of digital equipment is also able to improve the digital skills and competencies of our students in producing the innovations.” Meanwhile, Ng Mooi Hong, Headmistress of SJKC Tsun Jin, said: “In the current pandemic environment, teachers need to be creative in imparting knowledge and running the programmes that can develop the potential of our students. With this programme, we hope to inoculate the interest, highlight the potentials and empower the students with STEM subjects.” The E-Showcase PBL-TM Future Skills 2020 was the highlight of three (3) months long online learning programme for teachers and students of the two (2) schools. Throughout the programme, the teachers and students from both schools learned about digital technology in TM 3Ducation – the 3D printing module to be implemented in their PBL. Due to the ongoing pandemic Covid-19, TM’s strategic partner for TM Future Skills, Creative Minds, conducted the training sessions for all the teachers and students, including parents, through an online platform. Not being in class physically following the closure of schools nationwide has also not deterred these young innovators. They persevered in conducting research and continued to experiment and collaborated with each other virtually for the past 3 months. At the same time, School Improvement Specialist Coach (SISC+) from PPDBP closely supervised the activities and monitored the progress of the participants. Streamed live via YouTube, the E-Showcase garnered more than 6,000 viewers throughout the 2-day event and the channel has cumulated more than 7,800 views to date. The panel of judges for the E-Showcase consisted of SISC+ from PPDBP and led by Izad Ismail, Head of Corporate Responsibility, TM. TM Future Skills programme is an initiative that aims to empower students by equipping them and teachers with IR4.0-centric kits and knowledge, such as the TM 3Ducation – 3D printing module and the TM Nano Maker, a real-time data logging tool for STEM. This is to prepare them to be part of a digital-ready community and future-proof workforce which has always been one of the pillars under TM’s Digital Malaysia aspiration. As a key enabler of this, TM has always been an avid supporter of innovation and technology in Education. Through programmes like TM Future Skills, the Company endeavours to empower the leaders of tomorrow with relevant skills in innovation and technology towards serving a more digital society and lifestyle, digital businesses and industry verticals, as well as digital Government. For more information on the Company's other Corporate Responsibility initiatives, visit www.tm.com.my.

TM joins SK Telecom to Pioneer Multi-Access Edge Computing in Malaysia

SEOUL, 6 September 2023 – Telekom Malaysia Berhad (TM) and SK Telecom today inked a Memorandum of Understanding (“MoU”) to jointly develop the Multi-Access Edge Computing (MEC) business arrangement in Malaysia. This will pave the way for the business to be pioneered and provisioned in Malaysia. The signing took place at SK Telecom’s headquarters in Seoul in the presence of YB Fahmi Fadzil, Minister of Communications and Digital, Malaysia who had just arrived in South Korea for a working visit. TM was represented by Khairul Liza Ibrahim, TM Global’s covering Executive Vice President, while signing on behalf of SK Telecom was its Vice President and Head of Enterprise CIC of SKT, Kyeong Deog Kim. “I am happy to have witnessed the MoU signing between TM and SK Telecom as there are many opportunities that can be gained from such close cooperation and collaboration. I believe this MoU is a step in the right direction,” said Fahmi. Khairul Liza said, “TM remains steadfast in solidifying its stature as Malaysia’s preferred network infrastructure provider, catalysing digital industry and 4G/5G ecosystem while simultaneously positioning the country to become a digital hub for ASEAN. Our next step is to provide the means to empower all our customers in Malaysia and the region with multi-access edge computing from all our data centres around the country. Through this collaboration with SK Telecom, TM is stepping up its game to accelerate innovation for the nation’s progress towards a Digital Malaysia.” “Through collaboration with TM, we have once again confirmed that striving to provide faster and more stable services to customers through multi-access edge computing is a common interest of global telcos,” said Kim Kyeong-deog. “As we have been working actively to create a 5G ecosystem through the development of technology standards and use cases, we will put our best efforts so that our collaboration with TM contributes to creating a better communication environment in Malaysia.”