OUR GOVERNANCE MODEL AND FRAMEWORK

TM’s Governance Framework is crafted according to the rules, requirements and provisions laid out in the following documents:

- Companies Act 2016 (CA 2016);

- Main Market Listing Requirements (Main LR) of Bursa Malaysia Securities Berhad (Bursa Securities);

- Malaysian Code on Corporate Governance (MCCG) issued by the Securities Commission Malaysia (SC);

- Corporate Governance (CG) Guide published by Bursa Malaysia Berhad;

- Guidelines on Conduct of Directors of Listed Corporations and their Subsidiaries issued by the SC; and

- International best practices and standards on corporate governance.

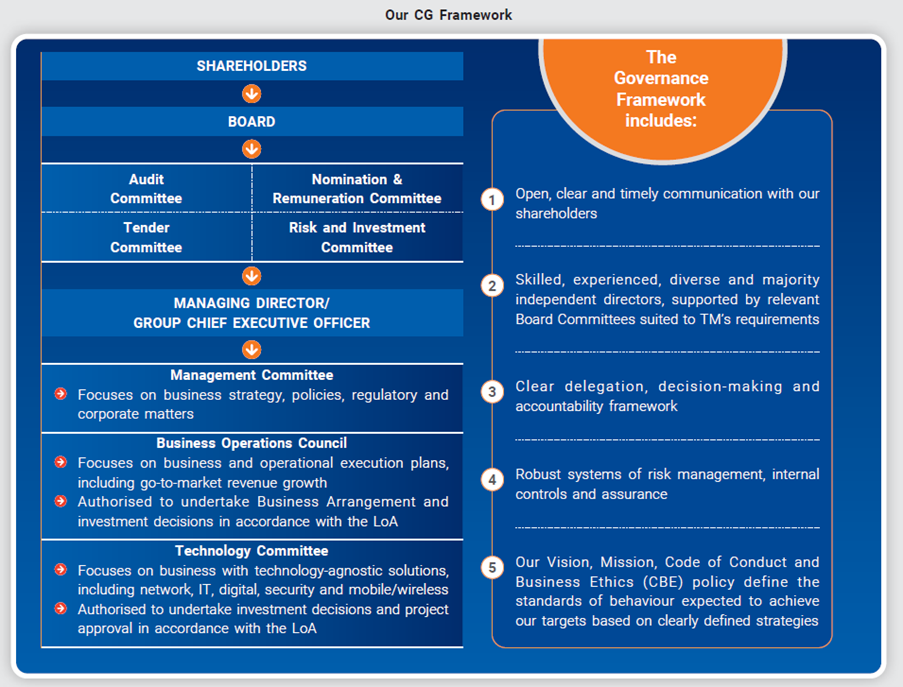

At the same time, our Board continues to align TM’s role as a public listed company (PLC) and government-linked company (GLC) whilst playing a key role in driving national initiatives towards a Digital Malaysia, ensuring sustainable development through connectivity and technology, while providing support to the nation through various Corporate Responsibility initiatives playing a key role in driving national initiatives towards a Digital Malaysia, ensuring sustainable development through connectivity and technology, while providing support to the nation through various Corporate Responsibility initiatives.

TM’s Governance Framework is supported by the Board Charter, Limits of Authority (LoA) Matrix, Business Policy and Governance (BPG) and the Directors’ & Management’s Conflict of Interest (COI) Policy.

For comprehensive overview of TM’s application of MCCG’s practices, the Corporate Governance Overview Statement, to be read together with the Corporate Governance Report (CG Report) 2024, further elaborates how the practices of the MCCG are applied and any departure thereto. The CG Report is available on the Company’s website at tm.com.my.

KNOW MORE ABOUT OUR CORPORATE GOVERNANCE

IN-DEPTH INFORMATION

Corporate Governance Report

This report sets out how the Company observes the intended Outcomes as prescribed in the MCCG.

Directors’ Statement On Risk Management And Internal Control

This statement outlines the nature and scope of the risk management and internal risk control within TM’s Group during the financial year under review.

TM Board and Subsidiaries Remuneration Framework

This policy ensures that our remuneration is market competitive and equitable while aligning with our strategic thrusts and value drivers as well.

Top Senior Management Remuneration Framework

The Policy supports our vision and drives our business strategy to attract and maintain talent. It encompasses terms of employment, reward structure, fringe benefits and pivotal positions.

Guide for Excellence in Corporate Governance

A compilation of the terms of references of our Board and Board Committees, practices, principles and codes as a primary source of reference on our governance policies.

TM Code of Conduct and Business Ethics

This Code provides guidance in resolving any business, legal and ethical issues that one may encounter when conducting business, as well as the standards of behaviour expected of all those in upper management.

The Companies Act 2016

As a public company limited by shares, enclosed is Telekom Malaysia’s Constitution and every statutory modification or re-enactment made since first being in force, including subsidiary legislation too.

TM BOARD RECOGNISES THE IMPORTANCE OF ADDRESSING CONFLICTS WITHIN THE BOARD SENSIBLY, FAIRLY AND EFFICIENTLY WITHIN THE COMPANY, IRRESPECTIVE OF THE PARTIES INVOLVED.

The Chairman and Senior Independent Director (SID) have a tacit role to act as the intermediary to resolve any issue or sensitive matter that arises between members of the Board. In instances of conflict or issues between Board members and employees involving unethical conduct of any member of the Board, TM has established a grievance procedure whereby aggrieved employees may escalate complaints against the Board member via a formal channel through the SID and/or the Company Secretary.

The SID and/or Company Secretary will evaluate and, if required, stream the complaint to the NRC Chairman for consultation to decide on the next course of action. If the complaint is substantiated and warrants further investigation, an independent ad hoc Board Ethics Committee will be established to review and investigate the complaint and recommend the next course of action to the NRC. Ultimately, TM Board will decide on the most appropriate action to be taken against the Director.